what do i need to bring to open a business bank account?

Questions you're searching: What should I bring to open a bank account?

Before you caput to the bank, make sure you accept the items listed below. And bank check out some FAQs almost opening and using your first bank account.

Maybe you're looking to get your finances in shape for the summer or hoping to be more financially contained every bit you lot head to college this fall — or both. No affair the reason, opening a bank business relationship at present could be a smart move because it can help yous more hands rails and manage your coin and abound your savings.

Some other perk? Whenever the need arises, you can quickly pay someone back or vice versa: Participating banks, including Wells Fargo, permit you ship and receive money in minutes with Zelle®, a digital payment network.1

Hither'southward how to get started:

*Some banks allow you to open an account lonely if you're younger than 18, so check with your fiscal establishment to run across what its policies are.

What practice I need to bring with me to open up a bank account?

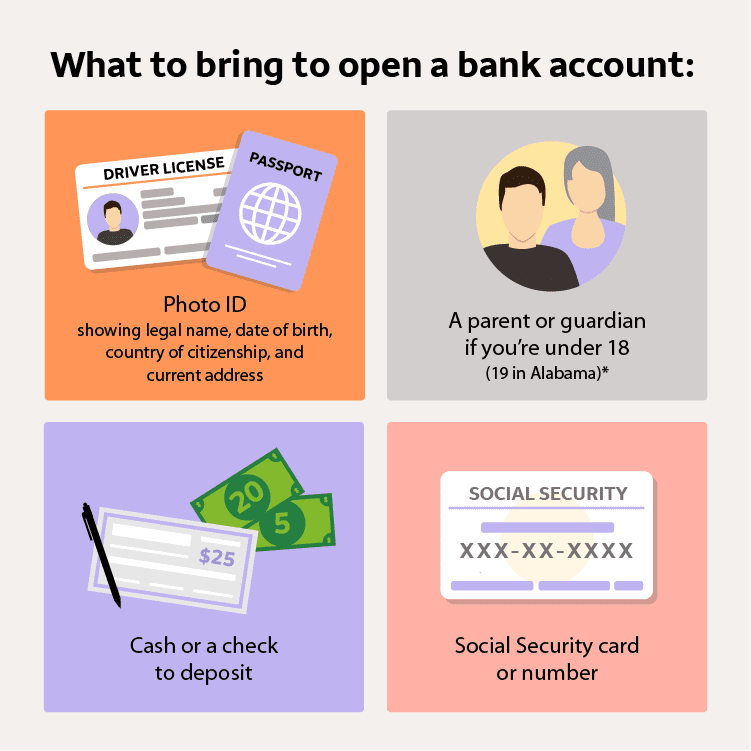

When opening a depository financial institution account, you should bring the following items with yous:

- A valid and current photo ID, such as a driver'south license, state ID bill of fare, or passport. This should show your legal name, appointment of nascency, country of citizenship, and current accost. (If your current accost is different from the 1 on your ID, a utility bill with the new address is required.)

- If you do not have either a photo ID or passport, bank check with your bank to encounter what your options are.

- A Social Security carte or number

- A parent or guardian if you're under historic period 18 (19 in Alabama)

- Some banks let yous to open an account lone if you're younger than eighteen, then check with your financial establishment to run into what its policies are.

- Greenbacks or a check to eolith into your new account

What type of depository financial institution account should I open?

Information technology depends. Practise you demand to pay hire, car payments, or other bills? Then a checking account may be best. You tin can choose to get a debit card, which lets you lot make purchases using the coin from your checking account. You can also utilize a debit card to withdraw cash from an ATM.

If you're non making payments — y'all just desire a place to keep your money and earn a lilliputian involvement — a savings account may meet your needs. You can get an ATM card to have access to greenbacks from your savings account at an ATM.

Want to do all of the above? Consider opening both a checking and a savings account. Opening both at the same depository financial institution and linking them could give you the convenience of easily transferring coin between accounts,2 and some banks may even offering some perks for opening both a savings and a checking account. Also check to see which account may have a special do good for students, such as waiving the monthly service fee, which Wells Fargo and many banks offer.

Exercise I need to make a minimum eolith in my business relationship?

Yes, many banks crave a minimum eolith to open an account. Wells Fargo requires a minimum deposit of $25 to open an account. Be sure to bring cash or a check with you so you'll be able to eolith money into your new account. Y'all likewise need to confirm whether in that location are whatever service fees that could be avoided by maintaining a certain balance in your bank account or coming together other criteria.

What happens if I withdraw more than than I accept in my business relationship?

If you spend more than yous take, you may exist charged a fee for having a negative balance (known as an overdraft charge). That'south why it's of import to get into the habit of reviewing your accounts daily. Another manner to help avoid that happening is setting up low balance alerts3 and so yous get a text or electronic mail when your account balance dips beneath a certain amount.

Many banks also offering optional overdraft protection services. With overdraft protection, you can link your checking account to another account, such as a savings account, so that overdrafts incurred on your checking account are covered by the available funds in the linked account. You may be charged a fee for the overdraft protection transfer, but it is usually lower than the bank'due south standard overdraft fee.

Wells Fargo and many banks also offer accounts with no overdraft or insufficient funds fees that may limit check writing and/or allowing an overdraft to occur. Talk to a broker when yous open up the business relationship; they can hash out the fees tied with your account and options you have to avoid them.

Will my parents exist able to see how I spend and save my money?

Information technology depends. If yous're nether the age of majority in your state, many states and financial institutions require parents or guardians to act equally co-owners, which means they take access to your account transactions and your money. (There are exceptions, though, so be certain to cheque with your financial establishment to run across what its policies are.)

The upside to having your parents or guardians on your account? They can help you keep runway of your balances and place when you demand to make deposits. If yous are 18 or older and parents or guardians are non included on your account, they can't see how your money is spent or saved.

What else tin I exercise with my bank account?

Once you lot open an account, familiarize yourself with it by logging in with mobile banking and checking on your money. You can also apply no-fee online tools, such as apps or personal finance websites, to help y'all track your spending.

When you monitor your banking company accounts, it becomes easier to see spending patterns — and where you may be falling short. For case, Wells Fargo offers My Money Map, which tin can help you lot track your finances. So, you can try putting goals in place and create a budget with this worksheet to help relieve more than money.

How else can we assist?

Connect with a broker to make sure you accept the accounts you need in higher and across.

Source: https://collegesteps.wf.com/what-should-i-bring-to-open-a-bank-account/

0 Response to "what do i need to bring to open a business bank account?"

Postar um comentário